In today’s fast-paced world, managing your finances effectively is more important than ever. With the advent of technology, budgeting has become easier and more efficient. A plethora of apps are now available that help you track your expenses, save money, and plan for the future. This article delves into the best budgeting apps and strategies for managing your finances smartly.

Why Use Budgeting Apps and Strategies for Managing?

Budgeting apps offer several advantages over traditional methods of managing finances. They are convenient, accessible, and often come with features that automate and simplify the budgeting process. Here are some reasons why you should consider using budgeting apps:

Automation and Ease of Use in Strategies for Managing

Budgeting apps automatically categorize transactions, making it easier to track expenses without manual entry. This saves time and reduces the chances of errors that can occur with manual tracking. Automation also means that you get real-time insights into your spending habits, which is crucial for making informed financial decisions.

Real-Time Tracking in Strategies for Managing

One of the significant advantages of using budgeting apps is real-time tracking of your expenses and income. With instant updates, you can see exactly where your money is going, allowing you to adjust your spending habits promptly. This immediate feedback loop is essential for staying within your budget and avoiding overspending.

Goal Setting in Strategies for Managing

Many budgeting apps allow you to set financial goals and monitor your progress. Whether it’s saving for a vacation, building an emergency fund, or paying off debt, these apps provide the tools you need to stay focused and motivated. By setting specific, measurable goals, you can track your progress and celebrate your achievements along the way.

Customizable Reports in Strategies for Managing

Budgeting apps can generate detailed reports that analyze your spending patterns. These reports can help you identify areas where you can cut back and allocate more funds toward savings or debt repayment. Customizable reports also allow you to tailor the information to your specific needs, providing a clearer picture of your financial health.

Top Budgeting Apps and Strategies for Managing Your Finances

Here are some of the best budgeting apps that can help you manage your finances more effectively:

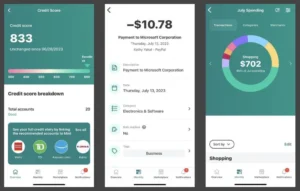

Mint

Mint is a popular budgeting app that offers a comprehensive suite of tools for managing your money. It connects to your bank accounts, credit cards, and bills, giving you a complete picture of your financial situation. Key features include:

- Expense Tracking and Categorization: Mint automatically categorizes your transactions, making it easy to see where your money is going.

- Budget Creation and Monitoring: Set budgets for different categories and receive alerts when you approach or exceed your limits.

- Bill Reminders and Alerts: Stay on top of your bills with reminders and alerts for upcoming due dates.

- Free Credit Score Tracking: Monitor your credit score for free and receive tips on how to improve it.

You can explore Mint further on their official website.

YNAB (You Need A Budget)

YNAB focuses on proactive budgeting, encouraging users to allocate every dollar they earn. Its unique approach helps users break the paycheck-to-paycheck cycle. Key features include:

- Goal Setting and Tracking: Set and track financial goals to stay motivated and on track.

- Real-Time Synchronization Across Devices: Sync your budget across multiple devices for seamless access.

- Detailed Financial Reports: Gain insights into your spending and saving habits with detailed reports.

- Personal Support and Online Workshops: Access personal support and participate in online workshops to improve your budgeting skills.

Learn more about YNAB on their official website.

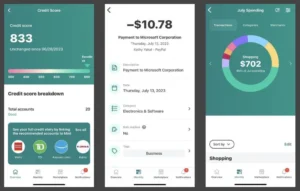

PocketGuard

PocketGuard simplifies budgeting by showing how much disposable income you have after accounting for bills, goals, and necessities. Key features include:

- Automatic Expense Categorization: Automatically categorize your expenses to see where your money is going.

- Bill Tracking and Alerts: Keep track of your bills and receive alerts for upcoming due dates.

- Savings Goals and Recommendations: Set savings goals and receive recommendations on how to achieve them.

- Customizable Spending Limits: Create spending limits for different categories to control your expenses.

Discover more about PocketGuard on their official website.

Goodbudget

Goodbudget is based on the envelope budgeting system, where you allocate money into different “envelopes” for various spending categories. Key features include:

- Envelope Budgeting: Allocate funds into envelopes for different categories to control spending.

- Sync and Share Budgets: Sync your budget across devices and share it with family members.

- Expense Tracking: Track your expenses to see how much you have left in each envelope.

- Debt Tracking: Keep track of your debt payments and progress.

Check out Goodbudget on their official website.

Effective Budgeting Strategies for Managing Your Finances

In addition to using budgeting apps, adopting effective budgeting strategies can further enhance your financial management. Here are some smart strategies to consider:

50/30/20 Rule: A Strategy for Managing Your Budget

This simple yet effective budgeting strategy involves dividing your after-tax income into three categories:

- 50% for Needs: Essential expenses like rent, groceries, and utilities. These are non-negotiable expenses that you must cover to maintain your standard of living.

- 30% for Wants: Discretionary spending like dining out, entertainment, and hobbies. These are non-essential expenses that you can adjust based on your financial goals.

- 20% for Savings and Debt Repayment: Allocating money towards savings, investments, and paying off debts. This category helps you build financial security and achieve long-term goals.

The 50/30/20 rule provides a balanced approach to budgeting, allowing you to enjoy life while still prioritizing your financial health.

Zero-Based Budgeting: A Strategy for Managing Every Dollar

Zero-based budgeting requires you to allocate every dollar of your income to a specific expense or savings category until your income minus expenses equals zero. This approach ensures that you account for every dollar and avoid unnecessary spending. Here’s how to implement zero-based budgeting:

- Calculate Your Income: Determine your total monthly income from all sources.

- List Your Expenses: List all your expenses, including fixed costs (rent, utilities) and variable costs (groceries, entertainment).

- Assign Every Dollar: Allocate your income to each expense category until your total income equals your total expenses.

- Adjust as Needed: Review and adjust your budget regularly to accommodate changes in income or expenses.

Zero-based budgeting provides a high level of control over your finances, ensuring that no money is wasted.

Envelope System: A Strategy for Managing Discretionary Spending

The envelope system involves allocating cash for different spending categories and placing it in physical envelopes. Once the money in an envelope is spent, you cannot spend more in that category until the next budgeting period. This method helps control overspending and promotes discipline. Here’s how to use the envelope system:

- Create Envelopes: Create envelopes for each spending category (e.g., groceries, entertainment, dining out).

- Allocate Cash: Allocate a specific amount of cash to each envelope based on your budget.

- Track Spending: Use the cash from each envelope for its designated purpose. When the cash is gone, stop spending in that category.

- Review and Adjust: At the end of the budgeting period, review your spending and adjust the amounts allocated to each envelope as needed.

The envelope system can be particularly effective for

controlling discretionary spending and avoiding impulse purchases.

Advanced Strategies for Managing Your Budget

To further enhance your budgeting efforts, consider these advanced tips:

Regularly Review and Adjust Your Budget: A Crucial Strategy for Managing Finances

Your financial situation can change over time, so it’s essential to review and adjust your budget regularly. Whether it’s a change in income, unexpected expenses, or achieving a financial goal, updating your budget ensures it remains relevant and effective. Set a schedule to review your budget monthly or quarterly, and make adjustments as needed.

Use Multiple Accounts for Different Goals: An Effective Strategy for Managing Funds

Consider using multiple bank accounts to separate your funds for different purposes. For example, have a separate account for emergency savings, another for travel funds, and another for daily expenses. This separation can help you stay organized and avoid accidentally dipping into savings meant for specific goals.

Automate Savings: A Strategy for Managing Consistent Savings

Take advantage of automation to make saving money effortless. Set up automatic transfers from your checking account to your savings account on a regular basis. This way, you’re consistently saving money without having to think about it. Many budgeting apps also offer features to automate savings based on your goals.

Track Your Net Worth: A Strategy for Managing Overall Financial Health

Tracking your net worth gives you a comprehensive view of your financial health. Your net worth is the difference between your assets (savings, investments, property) and liabilities (debts, loans). By regularly tracking your net worth, you can monitor your progress toward financial goals and make informed decisions about your finances.

Plan for Irregular Expenses: A Strategy for Managing Unexpected Costs

Irregular expenses, such as car repairs, medical bills, or annual subscriptions, can disrupt your budget if you’re not prepared. Plan for these expenses by setting aside a small amount each month in a separate fund. When the time comes to pay for these irregular expenses, you’ll have the funds available without affecting your regular budget.

Conclusion

Managing your finances smartly is crucial for achieving financial stability and reaching your goals. Budgeting apps provide the tools and insights needed to track your spending, save more, and plan for the future. By combining these apps with effective budgeting strategies, you can take control of your finances and pave the way to a secure financial future.

Start exploring these budgeting apps and strategies today, and see how they can transform your financial management!

Leave feedback about this